Choosing the wrong AI partner can cost you your next funding round. This is not an exaggeration, but the reality of the biotech market in 2025, which has become significantly tougher. Investors are no longer betting on “big ideas.” They are investing in measurable efficiency, technological maturity, and scalability.

New Reality: Only the Most Reliable Get Funded

The investment landscape has changed dramatically. According to Crunchbase News data for 2025, biotech startups received only about 8% of all venture capital investments ($16.6 billion) – the lowest figure in the last 20 years. Capital is now directed only to companies that can prove their reliability and effectiveness at the early stages.

“The current financial market is tough, and biotechs are finding it very difficult to get access to capital,” comments Samir Kagrana, Global Head of Strategic Deals at Fortrea, a contract research organization (CRO). “It takes at least ten years to develop a molecule, and that development is becoming more and more complex and expensive over time.”

A WeWillCure study (2025) confirms this trend: several promising biotech startups failed immediately after their Series A round due to weak technological infrastructure and the wrong choice of partners. Success today depends not only on a scientific breakthrough but also on how wisely a company builds its technological foundation.

Schedule a consultation to discuss how AI can enhance your biotech workflows – from data integration to R&D automation.

Book a ConsultationWhat Defines a Strong AI Partner in Biotechnology

Not all AI teams are equally helpful for biotech projects. Here are the key traits that distinguish a true partner from a mere contractor.

1. Domain Expertise, Not Just General ML Experience

Drug discovery and bioinformatics require a deep understanding of biology. A team that can’t tell transcriptomics from proteomics will not be able to build an effective tool. Successful companies like Insilico Medicine or Recursion Pharmaceuticals combine machine learning with validation in “wet” labs.

“They were highly skilled in both development and scientific application needs in discovery,” comments CEO of Dalriada Drug Discovery, Diana Kraskouskaya. The Blackthorn.ai team created a centralized data warehouse, automated data processing pipelines and a web portal.

Drug discovery and bioinformatics require a deep understanding of biology. A team that can’t tell transcriptomics from proteomics will not be able to build an effective tool. Successful companies like Insilico Medicine or Recursion Pharmaceuticals combine machine learning with validation in “wet” labs.

“They were highly skilled in both development and scientific application needs in discovery,” comments CEO of Dalriada Drug Discovery, Diana Kraskouskaya. The Blackthorn.ai team created a centralized data warehouse, automated data processing pipelines and a web portal.

2. Scalable Architecture and Process Transparency

It is of critical importance, that AI pipelinesmust bemodular, well-documented, and auditable — for scientific and regulatory reproducibility. A lack of explainability is one of the crucial reasons for distrust in AI tools within the scientific community. A reliable partner will always build an architecture ready for IND (Investigational New Drug) data submission.

3. Long-Term Partnership and Post-Launch Support

The true value of an AI model becomes apparent after its implementation, when it starts working with new data and requires continuous improvement. Short-term projects with a “build and forget” logic are a path to nowhere. A partnership implies joint development.

“Blackthorn.ai has a good understanding of our industry and the final results we need,” commented in Novamed. Right now, the team is creating a custom AI solution for a healthcare company.

The ROI of the Right Partnership: What the Numbers Say

Investing in a quality AI partner brings measurable financial benefits. According to internal Blackthorn.ai data for 2024, collaboration with specialized AI-bio teams can reduce early-stage drug discovery costs by up to 80%.

Infographic: ROI of AI Partnership in Drug Discovery

Investing in a quality AI partner is, first and foremost, a strategic investment. Below is a comparison of key efficiency metrics between the traditional approach to drug discovery and a process augmented by artificial intelligence.

| Metric / Stage | Traditional R&D (Industry Standard) | R&D with AI | Key Advantage and ROI |

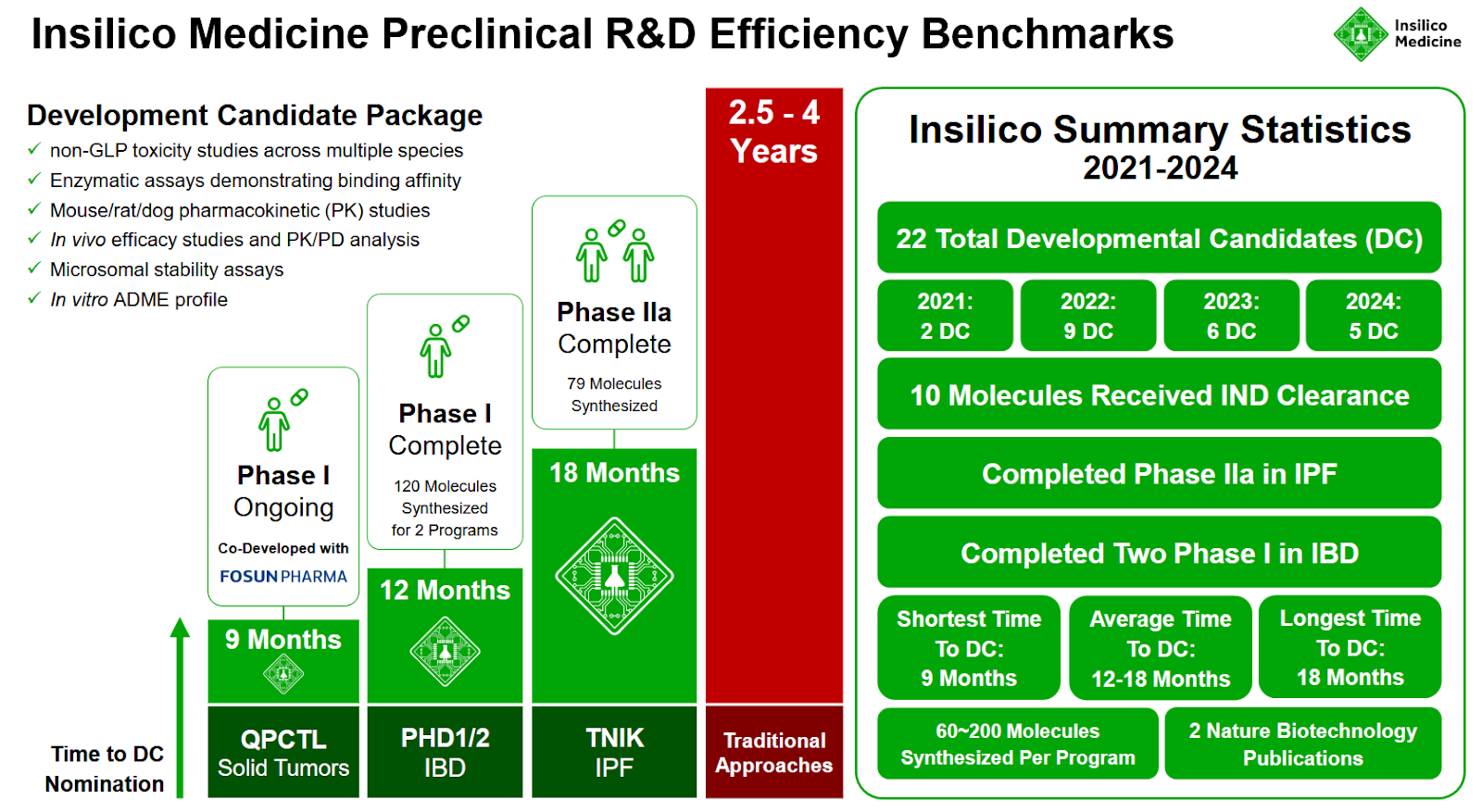

| Preclinical Development Time | 3–6 years | 1–2 years | Up to 70% R&D acceleration. A faster path to clinical trials is equal to securing the next funding round sooner and extending the patent protection period. Example: Insilico Medicine developed a preclinical candidate in 18 months. |

| Development Cost (per drug) | ~ $2.6 billion | Potential reduction of up to 70% | Radical reduction in capital expenditure. AI filters out unpromising molecules before expensive lab tests, saving millions of dollars. Example: Exscientia reduced costs by 80%, Insilico by 10 times. |

| Phase 1 CT Success Rate | 40–65% | 80–90% | Reduced risk of failure. A higher probability of success in early clinical phases is a critical factor for investors and increases the company’s valuation. |

| Target Identification and Validation | Months or years | Days or weeks | Saving the most valuable resource – scientists’ time. Automation allows the R&D team to focus on strategic tasks – rather than on routine analysis. |

| Prediction Accuracy | Limited by statistical methods | Accuracy >95% | Minimizing costly mistakes. Improved prediction of toxicity and efficacy in the early stages prevents investment in projects doomed to fail. Example: Bristol-Myers Squibb reduced the number of errors by 6 times. |

| Scale of Candidate Analysis | Thousands of physical compounds | Analysis of billions of virtual compounds | Expanding opportunities for innovation. AI allows for the exploration of a much wider chemical space, increasing the chances of finding a truly breakthrough molecule. |

Conclusion:

Scalability and automation, provided by the right AI partner, become a lifeline during “investment winters.” When capital is scarce, only companies that can demonstrate maximum efficiency at every stage survive.

Red Flags: Signals of an Unsuitable Partner

“Many, for example, underestimate the cost and time to reach key value inflection points (e.g., IND filing or Phase 2 proof of concept), particularly as costs of clinical trials have increased, or over-rely on a single asset without backups,” said Amy C. Reichelt, PhD, Neuroscientist and Neuropharmacologist and Senior Consultant at Cade Group, “Investors have become more conservative post-2021, particularly with higher interest rates, making it harder for small startup companies to secure early funding rounds.”

An unsuitable partner:

- Promises quick results without delving into your biological data.

- Cannot ensure the reproducibility and transparency of their AI pipelines.

- Lacks PhD-level experts or specialists with relevant domain expertise on their team.

- Offers generic solutions adapted from fintech or e-commerce instead of specialized tools.

- Does not have a clear project handoff plan and offers no post-completion support.

How to Evaluate Potential Partners: The “5C” Checklist

Use this simple check for a systematic evaluation:

- Competence: How deep is their knowledge in your specific scientific field – and in the relevant technologies?

- Collaboration: Are they ready to integrate with your R&D team? Can they work as a single, cohesive unit?

- Compliance: Do they understand data management regulatory standards (e.g., HIPAA, GDPR)? Can they follow them?

- Continuity: Do they offer long-term support? Do they provide model retraining, and optimization?

- Credibility: Do they have a proven track record in biotech projects?

AI in Action: Blackthorn.ai Project Examples

Case 1: AI platform for drug discovery based on multi-omics (HTG Molecular Diagnostics)

A great example of this in action is our AI Drug Discovery Platform case, where we automated molecular screening and affinity prediction – narrowing down over 36 billion molecules to just 10,000 top candidates, cutting R&D costs by an estimated $10 million+ and reducing hit identification time from a year to under 8 weeks.

Read the Full Case- Challenge: To accelerate development in precision medicine – integrate transcriptomic data for drug and target discovery.

- Result: Reduced early-stage costs by 80%. Identified 23 validated candidates with confirmed biological activity. Decreased the synthesis of unnecessary compounds by 90%.

- Collaboration: Blackthorn.ai developed an AI platform that combined transcriptome profiling and target validation. With each new dataset, the adaptive system improved its predictions.

Case 2: Platform for genomic data analysis (Vanda Pharmaceuticals)

Blackthorn AI developed a large-scale Genome Analysis Data Platform capable of processing 1000+ WGS samples 6x faster and fully automating genomics workflows. The platform handles hundreds of terabytes of sequencing data, enabling scalable, fault-tolerant analysis for disease research and pharma innovation.

Read the Full Case- Challenge: To create a scalable solution for processing hundreds of terabytes of sequenced data. Objective – is to identify genetic mutations associated with diseases.

- Result: Processed over 1000 whole-genome samples, increased data processing speed by 6 times. Achieved 100% automation of workflows.

- Collaboration: Blackthorn.ai designed a high-throughput platform with automated quality control, annotation, and visualization. The system allowed researchers to analyze data in real time.

Case 3: AI system for cardiodiagnostics (Monitoring Life)

One real-world example of this is our AI Cardiac Diagnostics Software case, where we used domain-adapted LLMs to analyze echocardiographic data and clinical reports – reaching 92% diagnostic accuracy, cutting report generation time by 65%, and improving patient triage efficiency by 40%.

Read the Full Case- Challenge: Develop a reliable AI system for extracting cardiovascular biomarkers from noisy ECG, PCG, and PPG data, which were collected from portable devices.

- Result: Achieved 99% accuracy, surpassing previous PoC solutions. The startup’s business hypothesis was validated in 4 weeks.

- Collaboration: Blackthorn.ai created a deep learning-based signal processing platform. The system ensured rapid clinical validation and readiness for pilot deployment.

The Future Belongs to Sustainable Partnerships

In an environment where funding in the biotech sector is shrinking, stable and deep partnerships become a key competitive advantage. Protecting R&D pipelines from future risks means achieving a harmonious blend of biology, data, and engineering. At Blackthorn.ai, we help biotech teams build AI infrastructure that works for years.

Learn more about our approach → https://blackthorn.ai/industries/pharma-biotech-software-development/