At the pre-seed stage, investors are rarely deciding based on depth of biology alone. Instead, short demos and early technical conversations quickly surface whether a team can translate an idea into something executable. The primary reason funding stalls is the presence of technical and execution red flags that appear within minutes-unclear validation logic, fragile data pipelines, unverifiable results, or dependence on individual intuition rather than systems.

This article examines the most common technical red flags investors identify in pre-seed biotech demos-across ideas, data, prototypes, and teams-drawing on diligence research and investor commentary, and outlines practical ways these risks can be reduced before entering fundraising.

Hypothesis framing and problem definition

Poorly bounded or over-scoped hypotheses are one of the earliest and most common rejection triggers in pre-seed biotech fundraising.

Investor diligence research consistently points to this issue. Analyses summarized in Nature Biotechnology show that a large share of early biotech programs fail not because the underlying biology is implausible, but because the initial hypothesis is too broad to test within realistic time and budget constraints.

At the pre-seed stage, investors expect teams to move from a broad problem space to a single, testable hypothesis. Each step-from problem framing to solution articulation-should progressively narrow scope and reduce uncertainty. When teams attempt to advance multiple hypotheses or platform claims in parallel, this progression breaks down. Instead of signaling ambition, it creates ambiguity around falsification criteria, validation timelines, and capital needs. For investors, this lack of focus translates directly into execution risk.

Investor retrospectives from firms such as Atlas Venture and Flagship Pioneering echo this: teams that try to validate multiple mechanisms, disease areas, or platform claims simultaneously make it difficult to assess what would falsify the idea, how long validation should take, or how much capital is actually required. Without a clearly bounded hypothesis, investors cannot model risk or design milestones, which is a core requirement at pre-seed.

In practice, demos that position a technology as applicable across many indications or biological pathways-without committing to a single, well-defined test case-are often perceived as unfocused. Even when the platform vision is credible, the absence of a narrow initial hypothesis raises questions about prioritization and execution discipline.

At the pre-seed stage, unclear hypothesis boundaries are interpreted as execution risk.

Data quality, reproducibility, and analysis

Non-reproducible or non-auditable data is one of the strongest technical deterrents for investors at the pre-seed stage.

This concern is supported by multiple large-scale reproducibility analyses. The widely cited Amgen study reported that only 6 of 53 landmark preclinical studies (~11%) could be reproduced internally, while a similar Bayer analysis found successful replication in only ~25% of evaluated projects-findings summarized and discussed in Nature Reviews Drug Discovery.

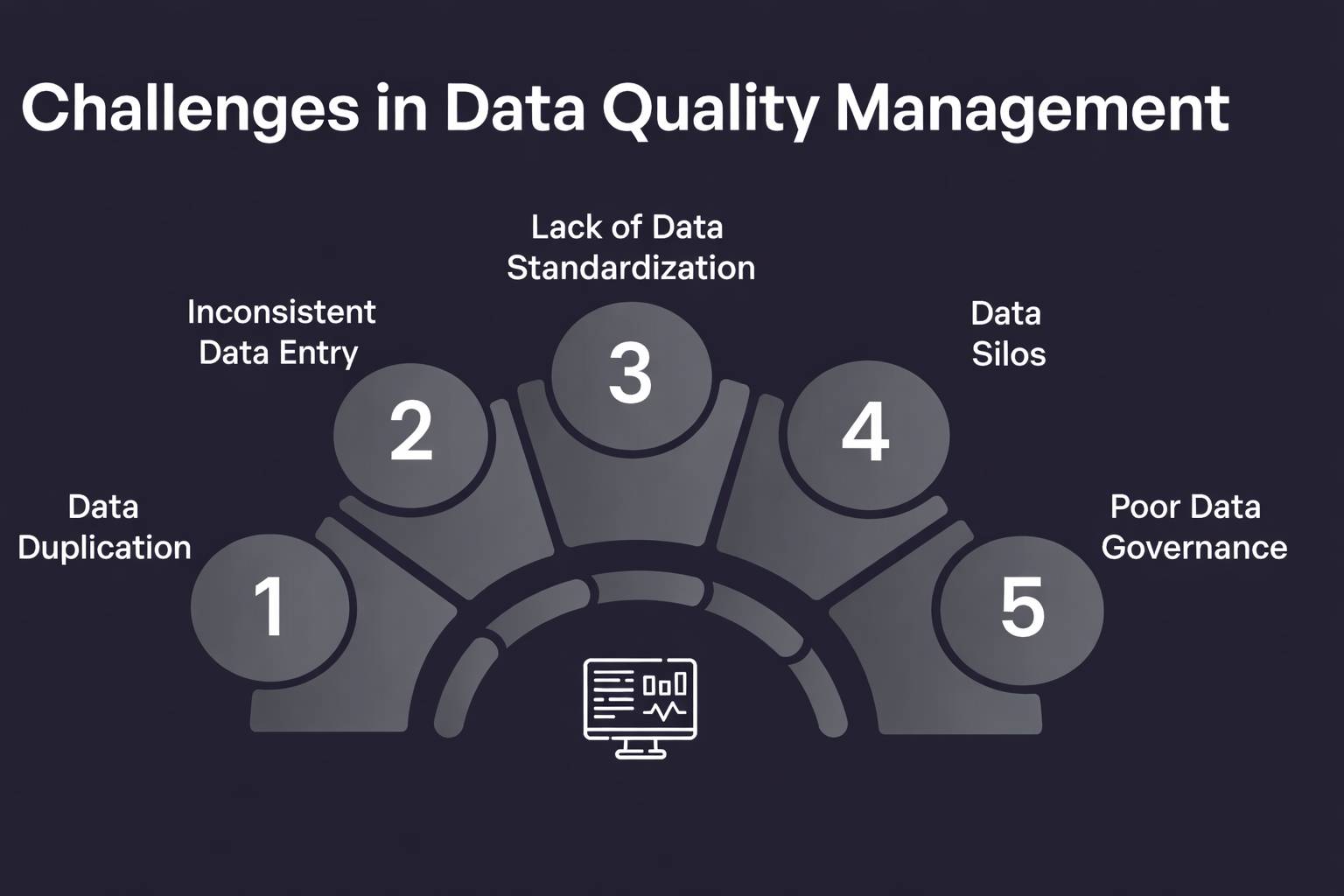

Issues such as duplicated datasets, inconsistent data entry, lack of standardization, siloed systems, and weak governance compound into pipelines that cannot be reliably rerun or audited. For investors, these failures signal that results may depend on manual intervention rather than controlled processes. When data lineage, preprocessing steps, and evaluation criteria are not explicit, even strong outcomes lose credibility because execution risk cannot be bounded.

Subsequent meta-analyses have linked irreproducibility not only to biological variability, but to inconsistent protocols, undocumented data preprocessing, manual result curation, and opaque analysis pipelines. As a result, investors increasingly treat data auditability-clear provenance, versioned analyses, and predefined evaluation criteria-as a proxy for scientific robustness and execution maturity.

Demos where figures cannot be regenerated on demand, where controls are not explicitly defined, or where parameter choices are justified only verbally raise immediate concerns. Even promising results are discounted if investors cannot trace how raw data moved through processing, normalization, and analysis steps.

For investors, data that cannot be independently reasoned about or rerun represents unresolved risk, regardless of how strong the headline results appear.

Execution systems and prototypes

At the pre-seed stage, the absence of an executable prototype is increasingly interpreted by investors as an execution gap rather than a timing issue.

This shift is visible in published diligence analyses and investor commentary. Reviews in Nature Biotechnology note that early-stage investors now differentiate teams based on whether execution assumptions are embedded in inspectable systems or explained only through narrative. Without an executable prototype, critical constraints-such as data availability, assay noise, model stability, compute limits, or iteration speed-remain implicit. These risks often surface only after capital is committed, which investors actively try to avoid. As a result, teams without prototypes are harder to evaluate, even when the underlying science is credible.

Demos that expose rerunnable pipelines, versioned workflows, or end-to-end experimental logic allow investors to reason about feasibility under real conditions. Even when results are preliminary, the ability to inspect how data flows through the system, how decisions are made, and how iteration would occur provides stronger diligence signals than static figures or slide-based explanations.

Without a prototype, execution risk stays hidden; with one, it becomes visible and assessable.

For biotech startups where early validation depends on showing how hypotheses are executed in practice, working with an experienced partner to design executable prototypes and execution systems can materially reduce time to validation and improve fundraising readiness. Blackthorn specializes in building such prototype-backed PoCs-complementing scientific and preclinical efforts by translating ideas into auditable, reproducible systems suitable for investor diligence at pre-seed and beyond.

For biotech teams where validation depends on showing how a hypothesis is executed, prototype-backed PoCs can shorten time to validation and improve fundraising readiness.

Book a ConsultationTeam dependency and scalability

Founder-dependent execution is a major perceived risk at the pre-seed stage.

Investor diligence consistently flags “key-person risk” as a primary concern in early biotech teams. In a 2024–2025 survey of life-science investors summarized by Silicon Valley Bank Healthcare Practice and echoed in PitchBook biotech diligence reports, over 60% of early-stage investors cited founder-centric execution as a material risk factor during pre-seed and seed evaluations. The issue is not founder competence, but fragility: when experimental logic, data processing steps, or decision rules exist only tacitly-inside one person’s head-investors cannot assess whether progress can continue under team growth, turnover, or parallel execution. From a diligence perspective, undocumented or non-systematized execution introduces hidden operational risk that cannot be priced accurately.

Demos where figures require continuous verbal explanation-“this part only works if you know how we cleaned the data,” or “the assay setup changes depending on who runs it”-signal that execution is not yet institutionalized. Even strong results are discounted when pipelines, protocols, or analysis logic cannot be followed independently by another scientist or engineer.

At pre-seed, investors look for execution that can outlive any single contributor. When progress depends on individuals rather than systems, scalability risk becomes a blocking issue during diligence.

Milestone logic and capital efficiency

Unclear milestone definitions and poorly organized capital use plans significantly undermine fundraising credibility for pre-seed biotech startups.

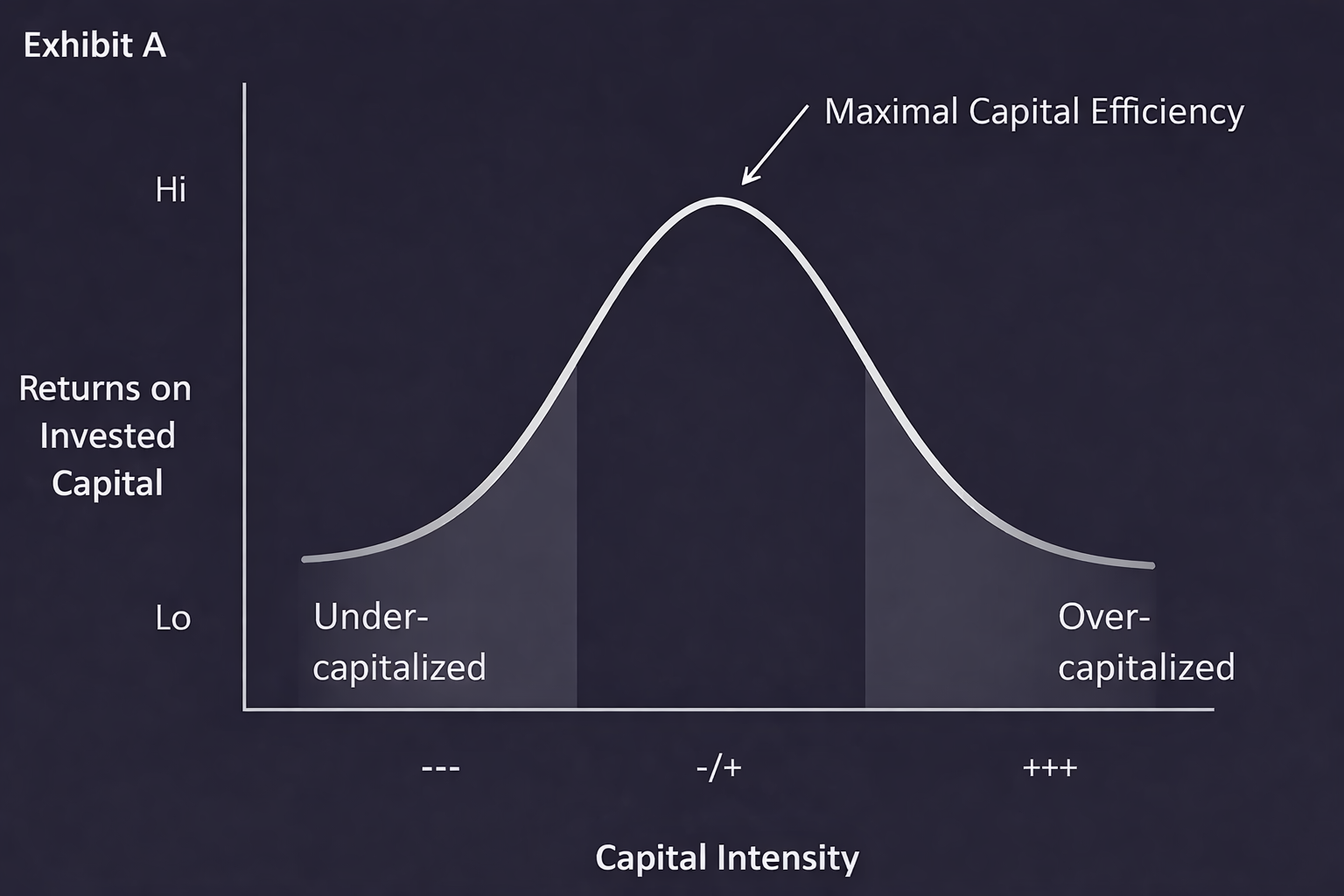

In 2025, biotech venture capital remains sizable overall – with hundreds of millions committed into early-stage funds like Curie.Bio Seed Fund II ($340M) and specialized vehicle raises – but capital allocation is becoming tighter and more milestone-driven. Early-stage deals still occur, but investors are increasingly funneling money into programs with visible risk reduction structures and clear next steps, particularly in preclinical innovation ecosystems. Analysts report that while the biotech industry’s total investment projected growth from $483B in 2024 to $546B in 2025, early-stage companies face pressure because VC pipelines increasingly favor milestones that materially reduce risk, leaving fragmented or vague plans at a disadvantage.

Investors evaluate whether a PoC is tethered to actionable next actions: what data set will be generated, what experiment will eliminate a major uncertainty, what readout triggers a decision, and what evidence is sufficient for follow-on capital. When demos focus on outcomes rather than structured decision checkpoints, investors see risk that capital will be spent without clarifying whether the science or execution is viable.

Programs that are under-capitalized often stall before reaching decisive validation, while over-capitalized programs consume funding without proportionate risk reduction. The peak of the curve reflects maximal capital efficiency: the point at which each increment of funding is tightly linked to a concrete milestone that meaningfully reduces scientific or execution risk.

Teams that articulate “if experiment X yields metric Y by T date, we will proceed to assay Z” are easier to underwrite than those who describe broad goals like “expand platform” or “explore additional use cases.” Startups with unclear thresholds for go/no-go decisions often prolong runway without demonstrable risk reduction, slowing investor confidence and term sheet momentum.

At the pre-seed stage, investors treat clear, risk-reducing milestones as capital efficiency signals and reward teams that can articulate structured decision logic rather than open-ended optimism.

Conclusion

Across pre-seed biotech fundraising, investor decisions are consistently shaped less by the originality of scientific ideas than by signals of execution quality. Evidence from diligence research, reproducibility studies, and recent venture funding patterns shows that poorly bounded hypotheses, non-auditable data, absence of executable prototypes, and vague milestone logic are among the most common reasons capital is withheld at early stages.

Clear hypothesis framing enables investors to assess falsifiability, timelines, and capital needs. Reproducible and auditable data pipelines reduce perceived scientific fragility. Executable prototypes make technical assumptions inspectable under real constraints. Explicit milestone logic links proof generation to capital efficiency. Together, these elements determine whether a PoC functions as a credible risk-reduction instrument rather than a narrative claim.

At the pre-seed stage, teams that surface constraints early-through systems allow investors to reason about feasibility, decision-making, and capital deployment with confidence. In an increasingly milestone-driven funding environment, execution transparency has become a prerequisite for early biotech investment, not an optional refinement.