- Customer Stories

- /

- AI Trading Platform Using Deep Reinforcement Learning

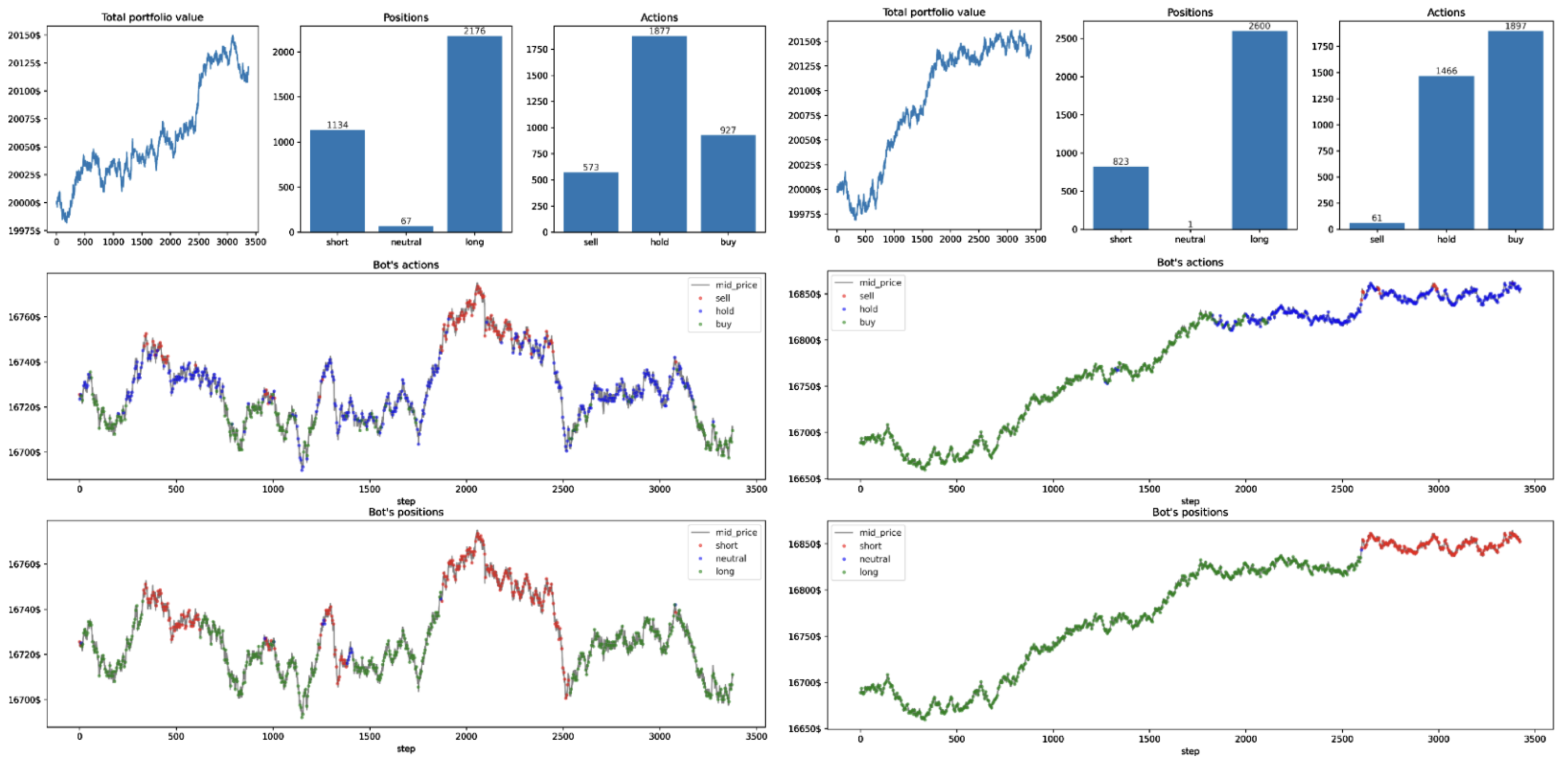

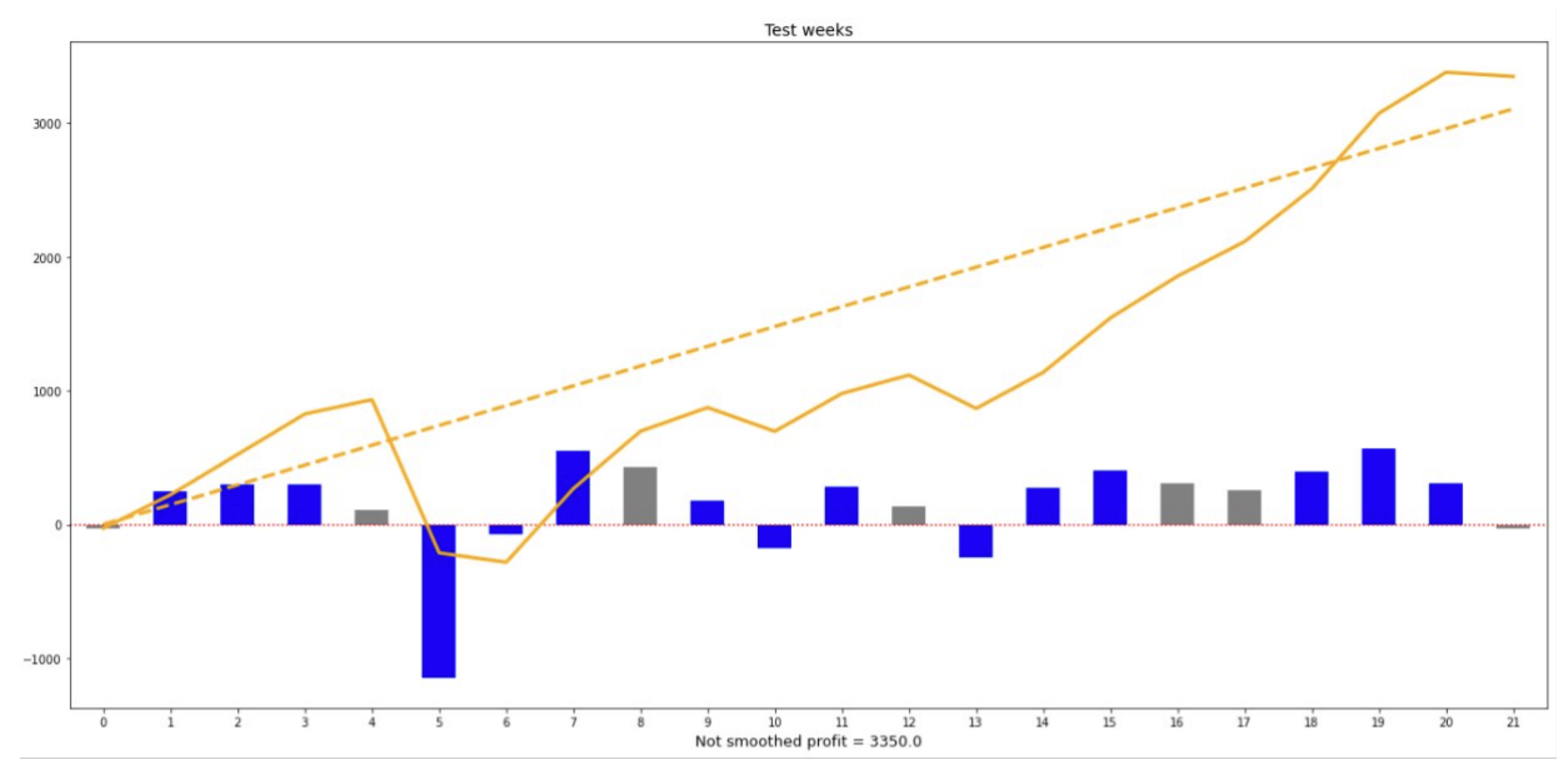

AI Trading Platform Using Deep Reinforcement Learning

Building resilient trading intelligence in stochastic, ultra-fast environments.

Sharpe Ratio delivers over 2x higher risk-adjusted returns than market benchmarks

Profit factor

Maximum drawdown

The entire pipeline operated in a fully automated loop covering training, evaluation, and deployment, all orchestrated through an MLOps stack that supported auto-updates and continuous retraining.

FinTech

Industry

AI/ML Development, Deep Reinforcement Learning (DRL), Trading Agent Architecture Design, Feature Engineering & Data Pipeline Setup, MLOps & Automation

Services

United States

Country

$150,000–$200,000

Budget

Managing sub-second trading across volatile markets is nearly impossible with traditional tools. The client needed a scalable, AI-powered trading system.

See what we can do for youSolution

We designed and deployed an end-to-end AI trading platform using Deep Reinforcement Learning (DRL) and built a factory of self-improving trading agents.

To designed and deployed an end-to-end AI trading platform, Blackthorn AI applied a production-grade tech stack including:

Project duration

Team Size

Delivering Impact

Beyond the values already highlighted, there’s even more to discover. Our commitment to innovation, client success, and impactful results sets us apart

Book a Meeting-8.5%

Maximum drawdownKept losses under 10% during peak-to-trough declines, ensuring controlled downside risk in volatile markets.

2.1

Sharpe ratioDemonstrates strong risk-adjusted returns, delivering more than double the excess return compared to volatility benchmarks.

1.9

Profit factorGenerated $1.90 in gross profits for every $1 lost, confirming consistent profitability.